bringing rolex into canada | Rolex luggage not working bringing rolex into canada Now that the tides have turned I'm thinking about buying a Rolex in Canada and bringing it down. From what I understand ONE Rolex purchased and worn across the border is .

Features & Benefits. Warranty: Standard : No Warranty, Expressed or Implied. Download. Pentosin DOT 4 LV is a special brake fluid of highest DOT 4 performance levels and extremely low viscosity at cold temperatures. It offers safety against vapor lock, has excellent resistance to absorbing/retaining water and provides superior corrosion .

0 · cbsa Rolex fine

1 · can you take Rolex overseas

2 · can you confiscate Rolex

3 · Rolex overseas fine

4 · Rolex over the border fine

5 · Rolex luggage not working

6 · Rolex baggage cost

Lai reģistrētos www.e-parvaldnieks.lv, jāaizpilda visi nepieciešamie lauki reģistrācijas formā. Pēc reģistrācijas jāpievieno namīpašuma objekts (dzīvoklis, par kuru tiks iesniegti dati). “Dzīvokļu vai telpu īpašniekiem” – autorizējoties ar internetbankas starpniecību vai izmantojot E-parakstu.

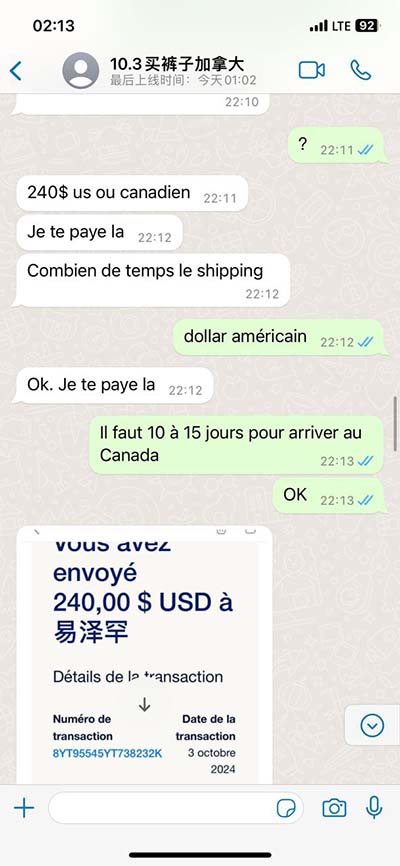

Estimate duty and taxes. From the Canada Border Services Agency. This tool provides an estimate only and applies strictly to goods imported for personal use. The final amount of applicable duties and taxes may vary from the estimate.If the value of the goods you are bringing back exceeds CAN0, you cannot .The Canada Border Services Agency (CBSA) facilitates the flow of legitimate .It was recently reported by the Associated Press that a Rolex enthusiast from Vancouver was fined ,000 for failing to declare his new Rolex worth more than ,000 at an airport. .

1.Is a Canadian who is non-resident in Canada allowed to bring in a Rolex from the USA without paying tax? (I reside outside north america but I've been stuck in Canada due to . Now that the tides have turned I'm thinking about buying a Rolex in Canada and bringing it down. From what I understand ONE Rolex purchased and worn across the border is .

If you bought a watch or expensive jewelry while you were abroad you must declare it, even if it’s from a nearby country like Canada. However, that doesn't mean you have to pay taxes on your items. Most travelers qualify for CBP exemptions. If you follow these simple precautionary steps you should have no issues traveling with one of your luxury watches, whether it's a Rolex, Tudor, Omega or Breitling watch - just . To Declare or not Declare Your Rolex. Following up on a story reported by the Vancouver Sun, a Canadian man must pay nearly ,000 (CDN) after failing to declare his . Anyways, I was wondering if any of you know the duties/import fees on watches coming into canada from japan. I ordered a Seiko SARB033 from Seiya Japan, and i'm just .

Importing a Rolex into Canada Rolex General Discussion. Rolex Forums - Rolex Watch Forum > Rolex & Tudor Watch Topics > > Rolex & Tudor Watch Topics >

cbsa Rolex fine

Estimate duty and taxes. From the Canada Border Services Agency. This tool provides an estimate only and applies strictly to goods imported for personal use. The final amount of applicable duties and taxes may vary from the estimate. When returning home to a non-EU country (the U.S., China, Japan, and Canada among many others), generally you must declare every single thing you purchased during your trip abroad. Don’t forget whatever you purchased at the airport like a watch at an airport boutique or an authorized dealer.It was recently reported by the Associated Press that a Rolex enthusiast from Vancouver was fined ,000 for failing to declare his new Rolex worth more than ,000 at an airport. Nearly a year ago, the man had bought the watch on a trip and only declared 0 worth of goods. 1.Is a Canadian who is non-resident in Canada allowed to bring in a Rolex from the USA without paying tax? (I reside outside north america but I've been stuck in Canada due to Covid for the last year and will be visiting the USA shortly and may purchase a Rolex).

Now that the tides have turned I'm thinking about buying a Rolex in Canada and bringing it down. From what I understand ONE Rolex purchased and worn across the border is no problem. That leaves me with 3 questions: What kind of sales tax will I pay in Canada (would be purchased in BC)?

If you bought a watch or expensive jewelry while you were abroad you must declare it, even if it’s from a nearby country like Canada. However, that doesn't mean you have to pay taxes on your items. Most travelers qualify for CBP exemptions.

If you follow these simple precautionary steps you should have no issues traveling with one of your luxury watches, whether it's a Rolex, Tudor, Omega or Breitling watch - just make sure the.

can you take Rolex overseas

can you confiscate Rolex

Rolex overseas fine

To Declare or not Declare Your Rolex. Following up on a story reported by the Vancouver Sun, a Canadian man must pay nearly ,000 (CDN) after failing to declare his ,510 (CDN) at Canadian customs. Anyways, I was wondering if any of you know the duties/import fees on watches coming into canada from japan. I ordered a Seiko SARB033 from Seiya Japan, and i'm just curious as to what i should expect on delivery. I'm really excited!

Importing a Rolex into Canada Rolex General Discussion. Rolex Forums - Rolex Watch Forum > Rolex & Tudor Watch Topics > > Rolex & Tudor Watch Topics >

Estimate duty and taxes. From the Canada Border Services Agency. This tool provides an estimate only and applies strictly to goods imported for personal use. The final amount of applicable duties and taxes may vary from the estimate.

When returning home to a non-EU country (the U.S., China, Japan, and Canada among many others), generally you must declare every single thing you purchased during your trip abroad. Don’t forget whatever you purchased at the airport like a watch at an airport boutique or an authorized dealer.It was recently reported by the Associated Press that a Rolex enthusiast from Vancouver was fined ,000 for failing to declare his new Rolex worth more than ,000 at an airport. Nearly a year ago, the man had bought the watch on a trip and only declared 0 worth of goods. 1.Is a Canadian who is non-resident in Canada allowed to bring in a Rolex from the USA without paying tax? (I reside outside north america but I've been stuck in Canada due to Covid for the last year and will be visiting the USA shortly and may purchase a Rolex).

Now that the tides have turned I'm thinking about buying a Rolex in Canada and bringing it down. From what I understand ONE Rolex purchased and worn across the border is no problem. That leaves me with 3 questions: What kind of sales tax will I pay in Canada (would be purchased in BC)? If you bought a watch or expensive jewelry while you were abroad you must declare it, even if it’s from a nearby country like Canada. However, that doesn't mean you have to pay taxes on your items. Most travelers qualify for CBP exemptions. If you follow these simple precautionary steps you should have no issues traveling with one of your luxury watches, whether it's a Rolex, Tudor, Omega or Breitling watch - just make sure the.

To Declare or not Declare Your Rolex. Following up on a story reported by the Vancouver Sun, a Canadian man must pay nearly ,000 (CDN) after failing to declare his ,510 (CDN) at Canadian customs.

Anyways, I was wondering if any of you know the duties/import fees on watches coming into canada from japan. I ordered a Seiko SARB033 from Seiya Japan, and i'm just curious as to what i should expect on delivery. I'm really excited!

the goyard artois

santee alley goyard

Flock and Fowl: Great food, Great Service! - See 52 traveler reviews, 32 candid photos, and great deals for Las Vegas, NV, at Tripadvisor.

bringing rolex into canada|Rolex luggage not working